Executive Summary: The Rapid-Fire Takeaways

🚀 Squarespace Catches a Tail-Wind

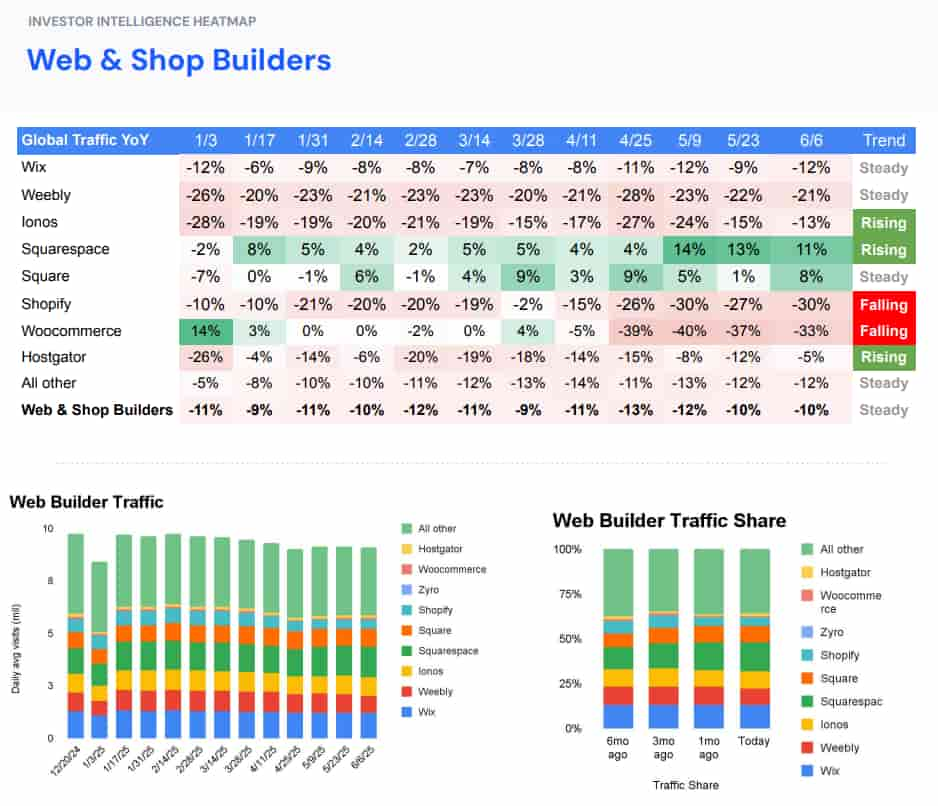

YoY growth rockets from -2% on January 1st to +14% in May, finishing June at +11%—the only platform solidly in double-digit green territory.

🔄 Quiet Recovery Mode

Ionos and HostGator are cutting their January double-digit declines roughly in half by June (Ionos -28% ➔ -13%, HostGator -26% ➔ -5%).

📉 Shopify's Slump Becomes a Slide

Growth sinks from -10% to -30%, marking the sharpest deterioration in the entire group.

💥 WooCommerce: From Hero to Zero

After opening the year at +14%, traffic craters to -37% by late May—a stunning reversal. Secure your WooCommerce store while traffic costs are low.

Sector Reality Check: The composite "Web & Shop Builders" index hovers around -10% to -13% YoY—steadily negative despite individual rallies.

Heat-Map Highlights: Where the Colors Shift

🟢 Persistent Green

Only Squarespace paints six straight spring weeks in green, suggesting its marketing blitz and refreshed templates are resonating beyond hobbyists.

🟠 Fading Reds

Ionos moves from blood-red (-28%) to less alarming orange (-13%), mirroring a broader European SME rebound.

🔴 Deepening Crimson

Shopify turns progressively darker after April—coinciding with fee hikes and increased competition from social-commerce channels.

⬇️ WooCommerce's Free-Fall

A lone bright-green January 1st square gives way to the map's darkest reds by May, suggesting merchant churn or traffic splitting with emerging headless stacks. Protect your WordPress/WooCommerce site with professional maintenance.

Market Dynamics: The Long Tail Persists

Absolute Volume Reality

Even as individual brands jockey for position, the "All Other" slice—hundreds of niche and regional builders—still commands the bulk of the 8-10 million daily visits.

Translation: Fragmentation hasn't disappeared; niche solutions remain viable.

Squarespace & Wix

Visible growth but not yet threatening the long tail

Ionos Recovery

Modest rebound barely moves the overall bar

Share Shifts

Squarespace gains ~1 point from Shopify in Q2

Strategic Implications for Founders & Marketers

1. Diversify Storefront Risk

If your funnel leans heavily on Shopify or WooCommerce, build backup channels while traffic costs are low. Test your platform security before switching.

2. Capitalize on Squarespace Momentum

Early adopters of its "Fluid Engine" layout are seeing discoverability bumps—good timing for redesign-driven relaunches.

3. Re-evaluate Legacy Hosts

HostGator's turnaround hints at renewed performance investment. Bargain hunters may find deals without sacrificing uptime.

4. Mind the Macro

Sector-wide -10% YoY suggests SMBs are trimming web budgets. Position upsells as cost-savers, not luxuries.

Platform Comparison: Winners vs Losers

| Platform | 2025 Growth | Pros | Cons | Security |

|---|---|---|---|---|

| Squarespace | +11% 📈 |

• Fluid Engine layout • Strong template design • Growing market share |

• Limited customization • Fewer integrations • Higher long-term costs |

Audit → |

| Shopify | -30% 📉 |

• Mature ecosystem • Strong app store • Proven scalability |

• Recent fee increases • Social commerce competition • Transaction fees |

Secure → |

| WooCommerce | -37% 📉 |

• Open source flexibility • No transaction fees • Full customization |

• Requires technical expertise • Security vulnerabilities • Maintenance overhead |

Fix Now → |

| Wix | -5% 📊 |

• User-friendly editor • AI design assistance • Strong SEO tools |

• Template lock-in • Limited migration options • Performance concerns |

Check → |

Security Recommendation: Regardless of platform choice, implement regular security audits and monitoring. The platforms showing decline may have underlying security issues contributing to user migration.

The Rotating Cast: What's Next?

Site and shop-building isn't a winner-take-all arena—it's a rotating cast of specialists adapting to changing market demands. Squarespace is this half-year's breakout star, but the larger narrative reveals a sector in mild contraction where smart pricing and domain-level value propositions determine who bleeds and who rebounds.

Looking Ahead to Q3

Expect the competitive tug-of-war to intensify as social-commerce giants continue luring traffic away and generative-AI site builders inch closer to production readiness. The platforms that survive and thrive will be those that can demonstrate clear ROI in an increasingly cost-conscious market.

For businesses and developers, the message is clear: diversification isn't just smart—it's essential. The landscape is shifting faster than ever, and yesterday's market leader could be tomorrow's cautionary tale. Learn why security-first businesses choose us to navigate these changes.

Stay Ahead of Platform Shifts

Market dynamics change rapidly in the e-commerce world. Subscribe to our analysis to catch the next platform surge before your competitors do.